Cryptocurrency continues to reshape global finance, offering ambitious Indians an exciting, high-growth pathway to financial independence. But how do you separate hype from substance—especially as a new investor bombarded by complex choices and market risks? In an exclusive podcast with Satish K Videos, Umesh Kumar, founder of SunCrypto—India’s leading FIU-IND registered exchange—shares his wealth-building blueprint, personal journey, and practical strategies for every crypto enthusiast in 2025.

Why Crypto Remains the Ultimate Wealth-Building Asset

Bitcoin was once the domain of techie dreamers. Today, it’s recognized globally as “digital gold”—a finite, decentralized store of value, outperforming traditional assets. Over the past decade, those who trusted the process and held strong through volatility have seen exponential wealth creation.

But that’s just one part of the story. Crypto isn’t just about Bitcoin—it’s about a new financial system open to anyone, anywhere, with as little as ₹100 to start.

Key Crypto Advantages:

- High Potential Returns: Top coins like Bitcoin and Ethereum have posted 40–70% annualized gains over the decade.

- Low Entry Barriers: Start SIPs with as little as ₹100/month.

- Global & 24/7 Market: Trade any time, bypassing banking restrictions.

- True Asset Ownership: With self-custody options (cold wallets), you control your funds.

The Mindset Shift: From Skepticism to Strategy

“2015 में जब बिटकॉइन $200 था, लोगों को लगता था अब बहुत महंगा है। आज जब $1 लाख है, वही गलती दोहराते हैं—सोचते हैं और महंगा हो गया।”

– Umesh Kumar

1 BTC = $118,657

That’s a mind-blowing +26,036% gain since the early days.

The number one barrier holding people back? Misinformation and fear. Whether you’re worried about scams, hacks, or market crashes, knowledge and discipline set successful investors apart.

Meet Umesh Kumar: India’s Young Crypto Visionary

Umesh’s journey started as a broke student, learning about Bitcoin through a friend at college. Undeterred by failures, bans (RBI’s crypto ban in 2018), and early mistakes (selling Bitcoin too soon), he persisted—eventually building holdings worth multiple crores.

He’s now the face of user-focused crypto investing in India through SunCrypto, helping over 500,000+ users access Bitcoin and 400+ other coins instantly, in INR.

The 3 Practical Ways to Build Wealth from Crypto in 2025

1. Regular Investing (Crypto SIPs & Lump Sum in Top Coins)

What Is It?

Just like mutual funds, you can set up a Systematic Investment Plan (SIP) in Bitcoin or Ethereum with as little as ₹100–₹1,000/month. Over time, the power of compounding and market growth creates life-changing wealth.

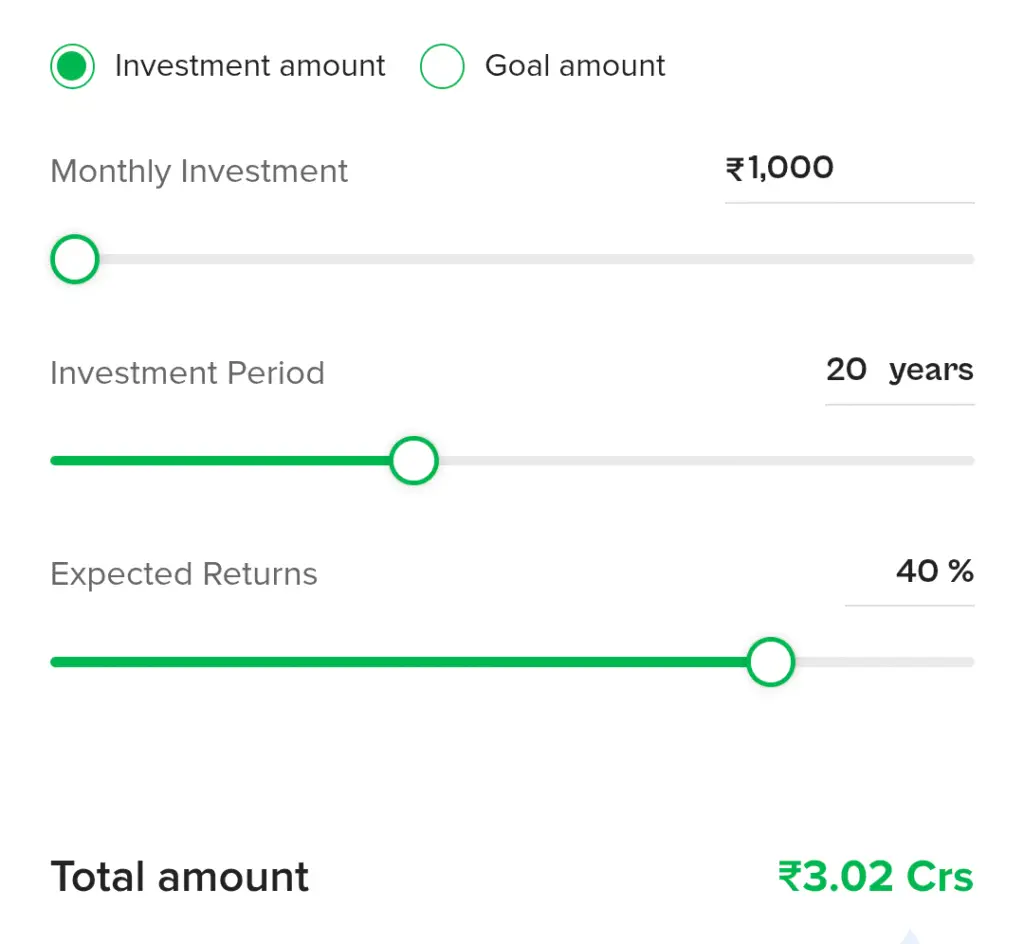

Umesh’s Example SIP Calculation

- ₹1,000/month for 20 years @ 40% compounded growth (conservative):

- Final amount: ₹2–₹3 crores

- Historically, Bitcoin’s CAGR has been 70–80%.

Pro Tips :

- Allocate ~40–50% of your crypto budget to Bitcoin, 30–40% to Ethereum, and the remainder to Solana, Polygon (MATIC), or other established coins.

- Avoid chasing meme coins for long-term wealth—these offer high risk and usually benefit only 2–5% of traders (“pump and dump” schemes).

How to Start :

- Create an account at a reputable exchange like SunCrypto.

- Complete KYC, deposit INR (UPI/IMPS supported).

- Start SIP or one-time purchase.

Tip: Even fractional Bitcoin/Ethereum can yield huge returns over time!

2. Active Trading (Spot, Futures, Options)

What Is It?

For more experienced users, short-term (intra-day, swing) trading or using derivatives (futures/options) can generate monthly income. Crypto markets run 24/7, offering unique flexibility.

Umesh’s Approach:

- Trade primarily in BTC/ETH for lower risk—avoid unknown, illiquid coins.

- Expert traders can earn 10–20% monthly—but this requires discipline, technical knowledge, and strict risk management.

- Use advanced tools—SunCrypto now supports futures for 600+ pairs with up to 75x leverage for pros.

Note: Never invest or trade money you can’t afford to lose. New investors should focus on SIPs and spot holdings first.

3. Crypto Startups & Ecosystem Opportunities

What Is It?

Beyond investing and trading, the crypto revolution is creating thousands of entrepreneurial roles. From DeFi (decentralized finance) products to payment gateways, P2P platforms, and international remittances, new use-cases are emerging daily.

Real-Life Example:

- SunCrypto itself was founded to solve the problem of complex, slow, and insecure trading for Indian users—bringing instant INR transactions, multi-layered security, and user-focused support.

- Overseas, you can now pay for cabs, hotels, and even luxury properties with Bitcoin!

Security and Regulation: Can You Trust Crypto in India?

Key Security Measures:

- Proof-of-Reserve Audits (POR): SunCrypto and other top exchanges regularly publish third-party audits to prove your funds are fully backed and never misused.

- Cold Wallets (Ledger): Assets are stored offline with multi-signature protection—major hacks are near-impossible.

- Insurance: SunCrypto insures funds held in custody (up to $120 million).

- Regulatory Compliance: FIU-IND registration, tax reporting, and only legitimate INR deposits (no risky P2P transactions with strangers).

User Self-Custody:

- Advanced users may use personal hardware (cold) wallets.

- Remember: if you lose your seed phrase or device, all funds are unrecoverable—so start slowly and always buy hardware wallets from reputable sources.

Legal Status (2025):

- India now taxes crypto gains at 30%—government is working towards full regulation (discussion paper expected soon).

- Real-time INR deposits/withdrawals possible via exchanges like SunCrypto.

- Read about regulations and tax: Government of India Crypto Guidelines 2025

Golden Advice from Umesh Kumar: Don’t Wait, Start Small—But Start!

Many regret not buying Bitcoin at $200, then $2,000, $20,000—and now wonder, “Is it too late at $100,000?” The truth: the journey is just starting. Even a small monthly investment can change your family’s financial legacy in 10–20 years.

“क्रिप्टो को ट्राई करो, छोटे अमाउंट से शुरुआत करो—क्योंकि आज नहीं किया तो कल रिग्रेट करोगे!”

Conclusion: Crypto Is the New Gold Rush—Learn, Plan, and Jump In

Crypto offers real opportunities—but only for those willing to educate themselves, invest consistently, and play the long game. Watch out for hype, focus on security, use reputable platforms, and start with what you can afford.

Ready to begin your crypto wealth journey?

Like this article? Share with your friends and family, drop your questions in the comments, and subscribe for more in-depth guides and real investor stories!

Read More : CoinDCX Security Incident: User Funds Safe After Internal Account Breach

Disclaimer: Cryptocurrency investments are subject to market risk. Do thorough research and consult financial advisors if needed. This article is for educational purposes only.

Pingback: Top 5 Proven Ways to Make Money on YouTube Using AI in 2025